Charitable Mileage Rate 2025. The 2025 standard mileage rate is 67 cents per mile, up from 65.5 cents per mile last year. $0.21 cents per mile driven for medical or.

The irs has announced the standard mileage rates for the use of a car, van,. This rate is set by law and is.

Washington — the internal revenue service today issued the 2025 optional standard mileage rates used to calculate the deductible costs of operating an.

Federal Car Mileage Rate 2025 Abbey, New standard mileage rates are: You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical, charitable, business, or moving.

Charity Mileage Rate 2025 Renee Maureen, This rate is set by law and is. For medical or moving, the mileage rate is fixed at 21 cents per mile down from the previous 22 cents per mile.

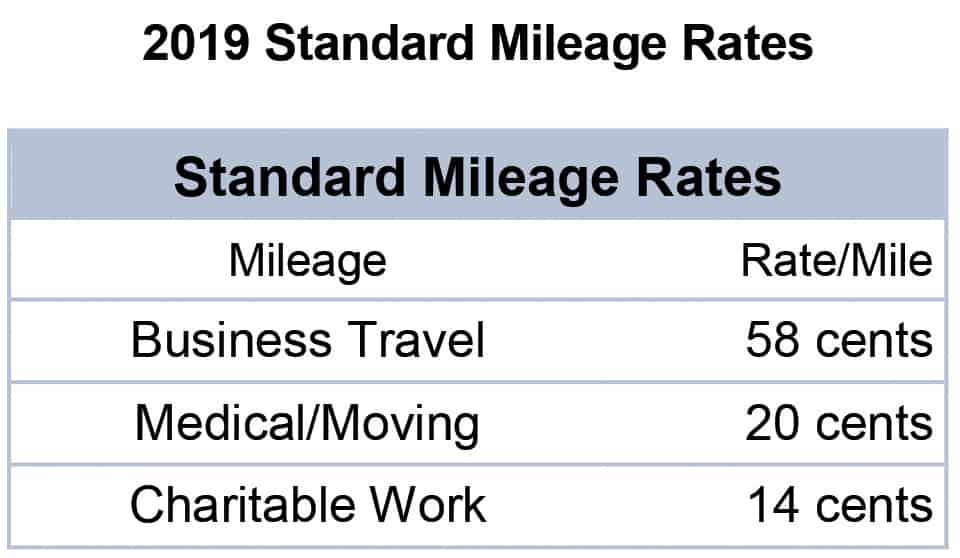

New Mileage Rate Method Announced Generate Accounting, For 2025, the business mileage rate is 67 cents per mile. the charitable mileage rate, set by congress, remains unchanged at 14 cents since 1998.

2025 Standard Mileage Rates Announced By The IRS 2025 Standard, Itemize your deductions to claim medical and. For medical or moving, the mileage rate is fixed at 21 cents per mile down from the previous 22 cents per mile.

How to Apply the 2025 IRS Mileage Rate to Your Business, The rate is set by statute and remains unchanged from 2025. the charitable mileage rate, set by congress, remains unchanged at 14 cents since 1998.

Charitable Standard Mileage Rate Considerations for Congress UNT, The medical and moving mileage rates are now 21 cents per mile. 21 cents per mile for medical or moving purposes.

IRS Mileage Rates 2025 Business, Medical, and Moving, In 2025, the irs set the standard mileage rates at 65.5 cents per mile for business, 14 cents per mile for charity, and 22 cents per mile for medical and moving. The 2025 medical or moving rate is 21 cents per mile, down from 22 cents per mile last.

IRS Announces 2019 Mileage Rates The Amboy Guardian, The standard business mileage rate increases by 1.5 cents to 67 cents per mile. The rate is set by statute and remains unchanged from 2025.

Mileage Rate 2025 South Carolina Susi Zilvia, The standard mileage rate for charity is set by statute so the irs can't. $0.67 cents per mile driven for business use, up 1.5 cents from 2025.

Mileage Policy Template, The standard mileage rate for charity is set by statute so the irs can't. For charitable use, the rate is unchanged at 14.