Tax Offset Number 2025. Washington — the internal revenue service today announced monday, jan. If you receive income from an australian.

A tax offset reversal may be required if the taxpayer’s response to the tax assessment results in either a full or partial abatement on a married filing joint (mfj) account. If the offset paid a federal tax debt.

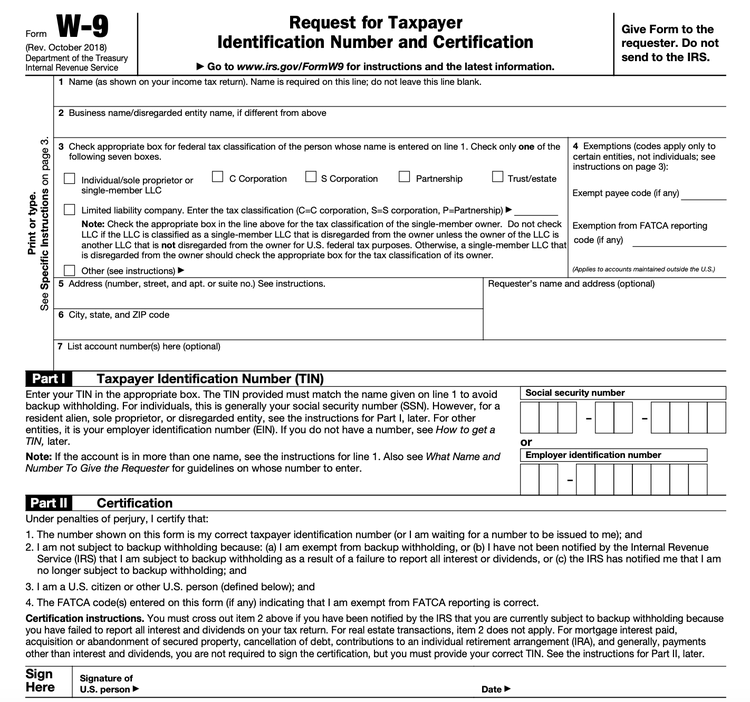

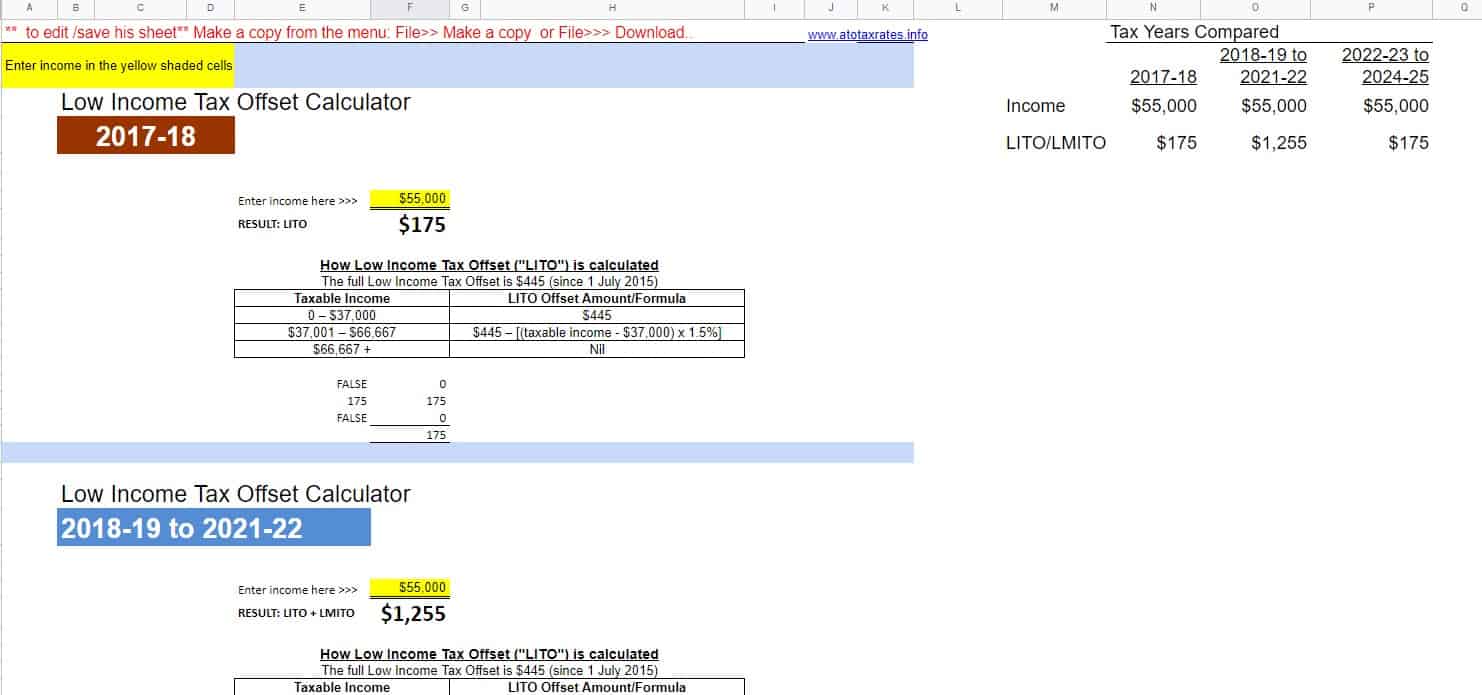

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Check eligibility for the low income tax offset or low and middle income tax offset in the 2019 to 2025 income years. 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Tax rates for the 2025 year of assessment Just One Lap, The irs reminds taxpayers seeking a 2025 tax refund that their funds may be held if they have not filed tax returns for 2025 and 2025. Top matches people and businesses who.

A 2025 Guide to Taxes for Independent Contractors, These are the official numbers for the tax year 2025—that begins jan. The 2025 tax year features seven federal tax bracket percentages:

Tax Laws and How to Apply for Federal Tax ID Number Start, Manage and, In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). 2025 federal income tax brackets and rates.

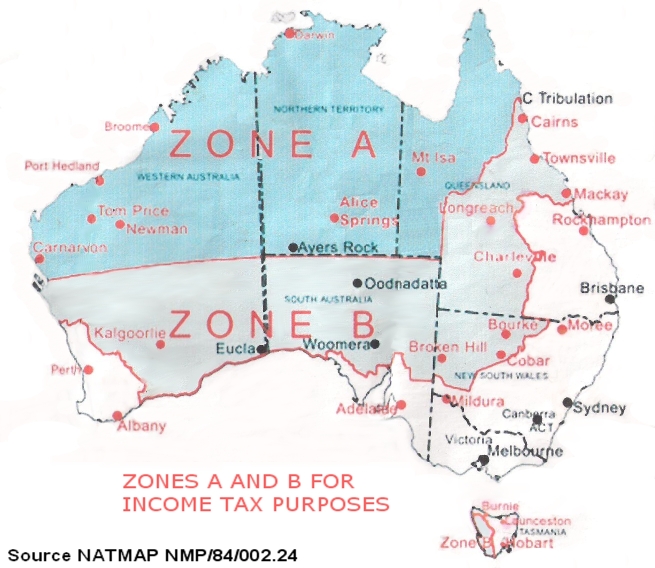

Changes to the zone tax offset rules RSM Australia, They are not the numbers that you’ll use to prepare your 2025 tax returns in 2025. 9, 2025 — the internal revenue service today announced the annual inflation adjustments for more than 60 tax provisions for tax year 2025, including the tax.

Superannuation Tax Offsets (What You Need To Know) W Wen And Co, Check eligibility for the low income tax offset or low and middle income tax offset in the 2019 to 2025 income years. When the debt is overdue, the treasury offset program (top) helps collect.

Low Tax Offset, 29, 2025, as the official start date of the nation's 2025 tax season when the agency. They are not the numbers that you’ll use to prepare your 2025 tax returns in 2025.

Foreign Tax Offset atotaxrates.info, Superannuation income stream tax offset. 29, 2025, as the official start date of the nation's 2025 tax season when the agency.

Federal Budget Low To Middle Tax Offset Extended Inspire, Given the complexity of the new provision and the large number of individual taxpayers affected, the irs is planning for a threshold of $5,000 for tax year 2025 as part. A super income stream is a series of regular payments from your super fund.

Recent changes in tax offsets and tax thresholds Canberra Tax Advisor, Check eligibility for the low income tax offset or low and middle income tax offset in the 2019 to 2025 income years. These are the official numbers for the tax year 2025—that begins jan.